Investing in 3D printing: a win-win?

Investment in industrial 3D printing is booming. Over the past two years, billions of dollars have been invested in the industry - with newer companies benefiting from the influx of funds. But what is this like in industrial practice, and what does the future hold for the industry as it receives increasing attention from investors?

We first turn back in time more than a decade; to early 2010. That was marked by much excitement and hype surrounding 3D printing due to the expiration of several patents. A revolution that would bring 3D printers into every home and allow consumers to produce 3D printed objects at the click of a button. A hype that drew attention: new companies flooded the market, investing millions in 3D printers. The stock prices of two of the largest manufacturers of 3D printers (3D Systems and Stratasys) skyrocketed. It seemed that 3D printing was on the verge of a new technological revolution.

Excitement proved premature

However, the excitement was premature: the consumer 3D printer revolution did not take off. Still, not as user-friendly as many had thought. But more importantly, a critical consumer application was never really developed that allowed 3D printing at home to really take off. As a result, the market for consumer 3D printers shrank significantly between 2014 and 2016. Not only did many of the new companies - particularly the manufacturers of small "desktop" 3D printers - struggle very hard, but investors also saw their share prices fall.

The era of industrial 3D printing

Fast forward to (almost) today: according to research firm Smartech Publishing, the 3D printing industry grew by 24% to $9.3 billion in 2018. In 2019, the market grew to $10.4 billion, crossing the double-digit billion threshold for the first time in the 3D printing industry's 40-year history. Even in the corona year 2020, growth between 5 to 10% is still reported, and all analysts predict continued growth for the next few years. But where is this resurgence coming from? The answer: industrial 3D printing.

Also already in practice

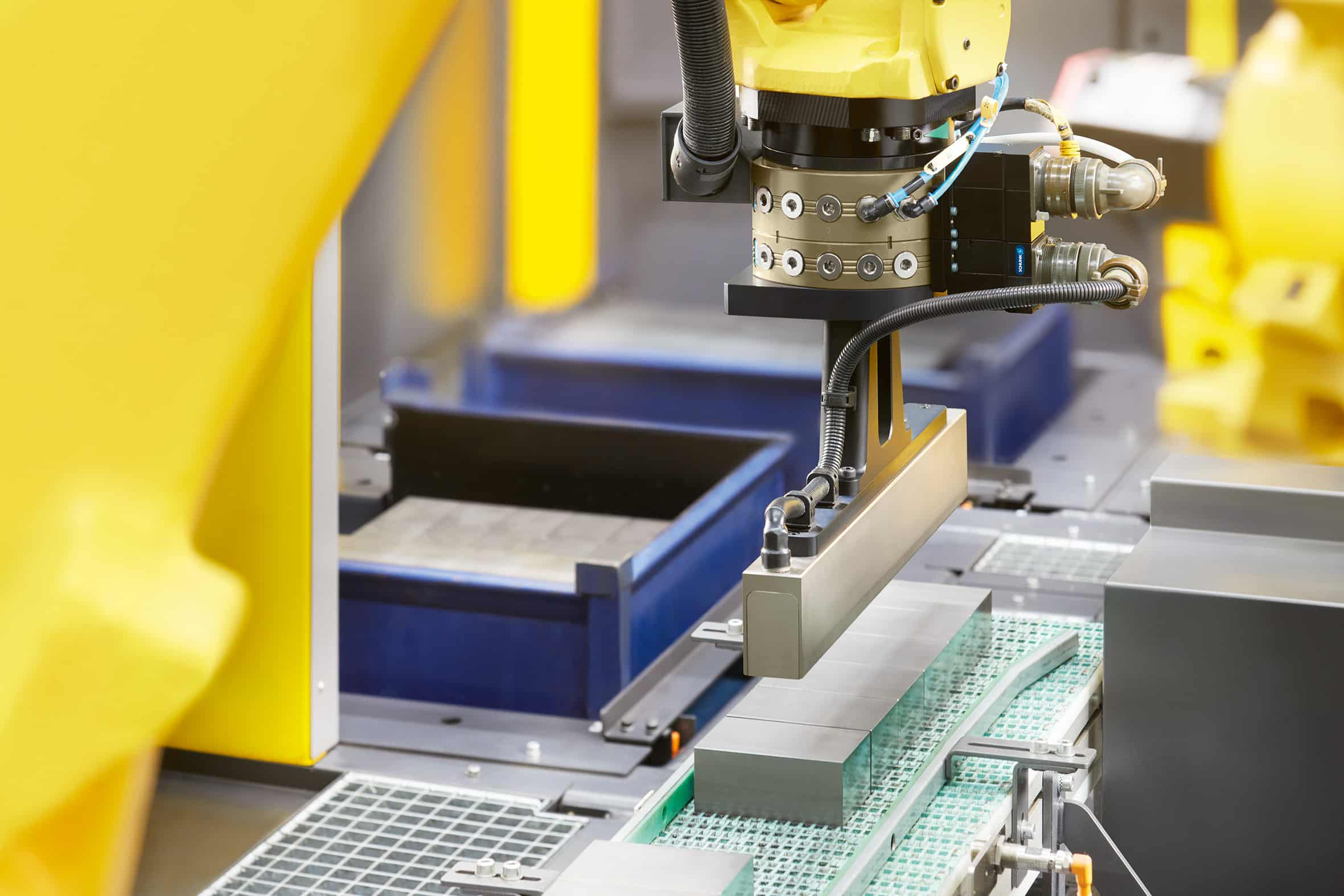

Although the vision of a consumer market for 3D printing has not yet fulfilled its promises, 3D printing has emerged as a promising technology for industrial production, accelerating product development processes and producing more and more end-use parts. Demanding industries such as automotive, aerospace, medical and engineering are installing 3D printers, which print parts in both plastics and metals - and putting them to practical use.

Auto giant Volkswagen, for example, announced a center for digital manufacturing and 3D printing in late 2018. The company revealed a very detailed roadmap, showing that it would 3D print 50,000 to 100,000 football-sized functional parts per year by 2021.

AM in series production

According to 3D printing analyst Terry Wohlers, nearly $1.5 billion will be spent on 3D printing end parts worldwide in 2019. In 2016, the counter was still stuck at over 600 million. More than double in three years. We also see the same shift in the Benelux market in the late 2020s survey: prototyping remains important as an application for 3D printing, but eventually the break-even point - at which the use of AM becomes economically the best choice - shifts inexorably toward series production. To make advances in print speed, choice of materials and cost of machines, the companies behind the technologies need significant funding. And they seem to be getting those. Not surprisingly, as 3D printing turns to real-world industrial applications, its potential is very attractive to investors.

Complementary technology

Still, it is important not to fall into the same trap as during the consumer hype of 3D printing. Industrial 3D printing will not replace conventional manufacturing methods, at least not in the short term. Rather, it is a complementary technology that offers new design possibilities, enables new applications and lowers production costs.

Flemish and Dutch manufacturing companies are also beginning to realize this. In any case, the willingness to invest in the technology is high: the Flam3D survey in Flanders and the Netherlands shows that 80% of manufacturing companies want to invest in (additional or new) printing systems, just under half want to buy software for 3D printing, some 30% want to buy external know-how...

Ready to grow

When it comes to growth, access to financing often still seems to be a bottleneck in the Benelux: a few promising start-ups are in the starting blocks, ready for a lightning start, but often only with great difficulty (and sparingly) get the necessary resources to effectively get that flying start. However, there are clearly some companies with global potential. The growth of the 3D printing industry is significant, and the currently nearly $12 billion industry is expected to continue to grow significantly. Major players see great potential, and the entry of major companies such as HP, BASF and GE shows an intention to disrupt the global manufacturing market as the technology continues to advance. With such a great road ahead for 3D printing, it makes sense that the path to funding is an important part of the journey. While the landscape is more competitive than ever, it presents opportunities to develop and grow new processes and business strategies - and investors are watching developments closely.

As a neutral industry organization, Flam3D offers access to a portfolio of start-ups and scale-ups active in 3D printing. Looking for info or partners? Contact us.