What does military expansion mean for the Dutch metals industry?

The announcement by General Onno Eichelsheim, the Netherlands' highest military officer, to accelerate the readiness of the armed forces for possible deployment marks an important turning point for the Dutch defense strategy. Together with the government's decision to increase defense spending by more than a billion euros, this means not only a strengthening of the military, but also a significant boost for various sectors within the economy. One of the sectors that may be directly and dramatically affected by this is the metals industry. In this article, we explore the impact this military expansion may have on the Dutch metals industry. What will change in terms of production, innovation, employment and international positioning?

Increasing demand for metal products

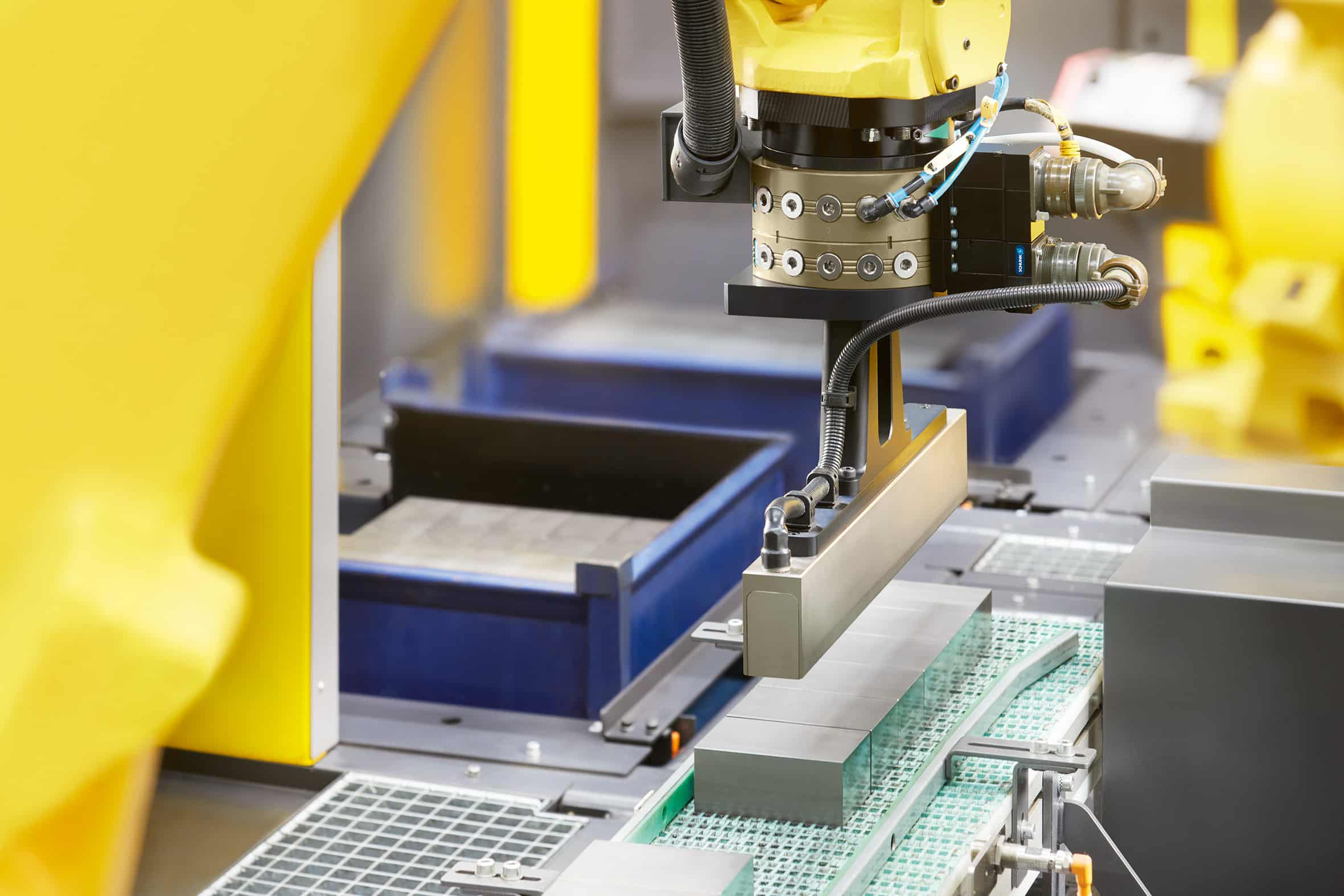

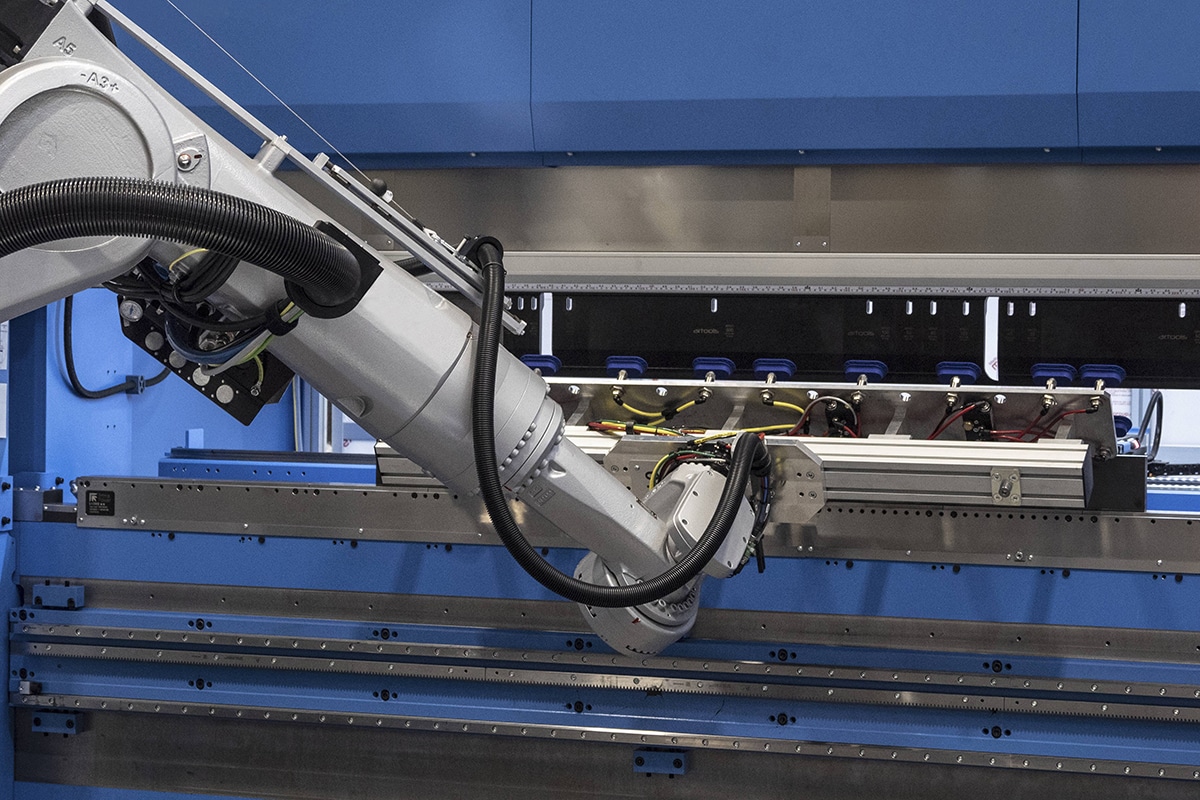

One of the most immediate consequences of military expansion will be the increased demand for metal products. The production of modern weapon systems, vehicles, aircraft and other military hardware requires large quantities of metal. These include steel, aluminum, titanium and copper. These products are indispensable in the production of combat vehicles and tanks, aircraft and drones, ships and submarines, weapons systems and ammunition, communications and radar technology. But robust metal structural materials are also needed for the construction of military infrastructure, such as barracks, training grounds, ammunition depots and maintenance facilities. All this may lead to increasing pressure on production capacity within the metalworking industry. Due to these new developments, Dutch metal companies may increasingly start receiving orders from Defense. This may result in an increase in turnover and a need to expand production capacity. Companies will then be challenged to deliver faster, more efficiently and on a larger scale. An important consequence may be that suppliers also benefit. From producers of basic materials to high-tech metalworking companies, the entire chain can be activated. This creates room for investment in new production lines, automation and tapping into innovative metal applications.

What several Dutch metal companies are already making for defense:

- Radar systems, working extensively with metalworking suppliers

- Naval vessels and patrol ships, again working with an extensive network of metal companies

- Components for vehicles and military systems

- Innovative defense applications

Innovation and technological development

Increasing the defense budget offers the metals industry not only additional sales but also an impetus for technological innovation. To meet the high demands of military applications - think weight, durability, corrosion resistance and precision - advanced production methods such as 3D metal printing, laser and plasma cutting, composite-metal combinations, nano coatings and alloys with special properties are increasingly being used. Cooperation between defense, knowledge institutions and industry is recommended by the Advisory Council for Science, Technology and Innovation (AWTI), among others, which issued the advisory report "Knowledge Offensive for Defense. This can create new opportunities for startups and R&D departments of existing metal companies to experiment with innovative applications that will later be applicable outside the military sector.

Impact on employment

Expanding military production capacity also has social and economic benefits. The metal industry may receive a significant boost in employment. There will be additional demand for skilled workers such as welders and CNC machinists, production engineers and metalworkers, quality controllers and R&D specialists. To meet this growing personnel demand, training and collaborations with technical training institutes and MBO institutions will be essential. Regional training centers can play a key role here by capitalizing on defense-related modules within their metal engineering programs. Also VDL Nedcar of Born, which previously saw hundreds of jobs put at risk following the departure of major car brands MINI and BMW, can create new jobs through new defense-related production and retain and perhaps expand existing employment. Because of its existing high-tech assembly capabilities and metalworking expertise, VDL Nedcar can play an important role in the assembly of military vehicles or their components.

International opportunities

An enhanced role of our country within NATO and EU defense projects also offers Dutch metal companies new export opportunities. Joint procurement programs, such as the European Defense Fund (EDF) and Permanent Structured Cooperation (PESCO), create opportunities to participate in international tenders and cooperation projects. Dutch companies that distinguish themselves through quality, innovation or flexibility can thereby expand their market to allies inside and outside Europe. This not only strengthens the sector's economic position, but also contributes to the Netherlands' strategic autonomy in the defense field.

Sustainability as challenge and opportunity

Accelerated militarization also brings new demands for sustainability. Both Defense and industry are under pressure to keep their carbon footprint as small as possible. Green production methods, metal recycling and energy-efficient processes are becoming increasingly important, including in military production. This can give new impetus to sustainability initiatives within the metals industry.

Indispensable link

Military expansion, could bring sweeping change for the Dutch metals industry. The industry may be on the eve of

a period of growth, innovation and internationalization. By responding to increased demand for metal products, technological innovation and sustainability requirements, the Dutch metal industry can become an indispensable link in the modern defense chain.