Automated material handling From useful to necessary?

Metal and steel processing companies usually see new machinery within the production process as a necessity. What about automation tools such as material handling equipment and robotics? Plus: how do you get started and what is the ROI?

Investment in equipment generally comes in two categories: necessary or convenient. Necessary: when production stops due to a faulty machine, repair or replacement is needed. Convenient: a smart addition to an existing process. Cost plays a role in investment decisions, but less than expected. The cost of a new CNC machine ranges from a few tens of thousands to sometimes as much as a million euros. The cost of automated internal transport is usually below that.

25 percent annual growth

Demand for automated material handling has been increasing in recent years. Analysts at The Insight Partners expect 25 percent annual growth in automation for improving industrial processes through 2031. This global trend can also be seen in the Netherlands. Reasons for deploying material handling equipment within production and logistics environments abound. Automated Guided Vehicles (AGVs) are certainly among the most interesting tools for smaller and medium-sized metal and steel processing companies, in addition to mobile robots (AMRs). Three suppliers of material handling equipment, Kumatech, KV Techniek and Omron see that entrepreneurs want to use them primarily to respond to staff shortages and increase the efficiency of internal processes.

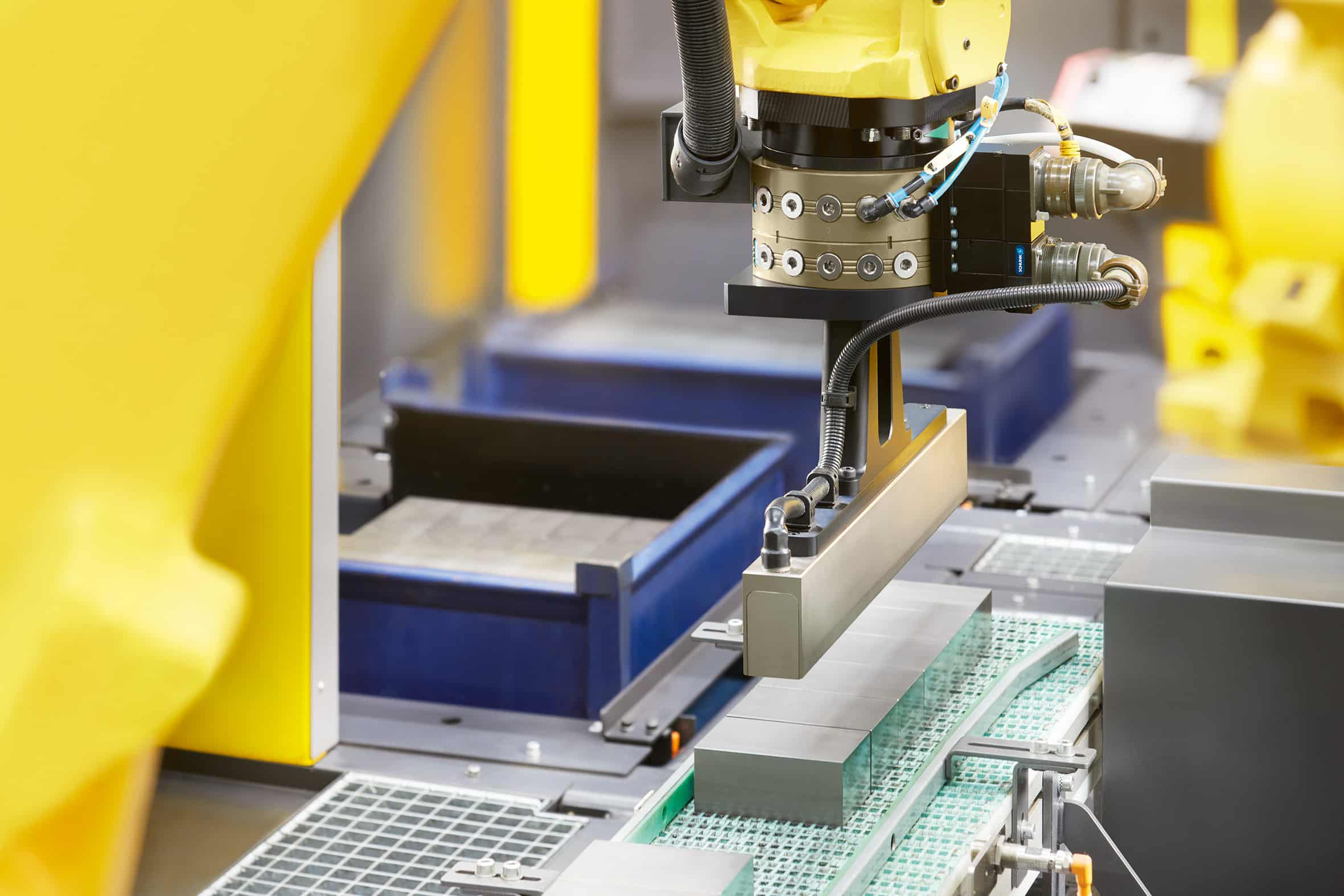

Automating repetitive actions

Automated material handling is especially practical for a number of repetitive logistics and production support movements. These include transporting materials from storage to the production site, moving semi-finished goods between production steps and delivering finished goods to storage or transport locations. In addition, companies can use the resources for support during production processes or disposal of excess material.

Responding to lack of skilled personnel

According to Kumatech, KV Techniek and Omron, the demand for internal transport equipment is clearly increasing. According to Kumatech company manager John Jaspers, the reasons are threefold: "Entrepreneurs cannot get enough good skilled personnel, such as forklift drivers. Therefore, they are automating what is possible. In addition, automating activities can help improve competitiveness. Finally, the use of automated material handling can improve safety within a company." Another aspect, but not among the top three arguments according to Jaspers, is ergonomics. "For example, in the case of pallet dispensers. A safe, efficient and tidy workplace results in fewer risks, fewer frustrations and contributes to job satisfaction."

Save time and arbreid

Bastiaan Krijger, founder of KV Techniek: "In the food industry, for example, you saw automation and robotic solutions before. Now you also see it happening in metal processing companies. The reason: saving time and labor, which reduces costs. Self-driving forklifts are a good replacement for forklifts with drivers."

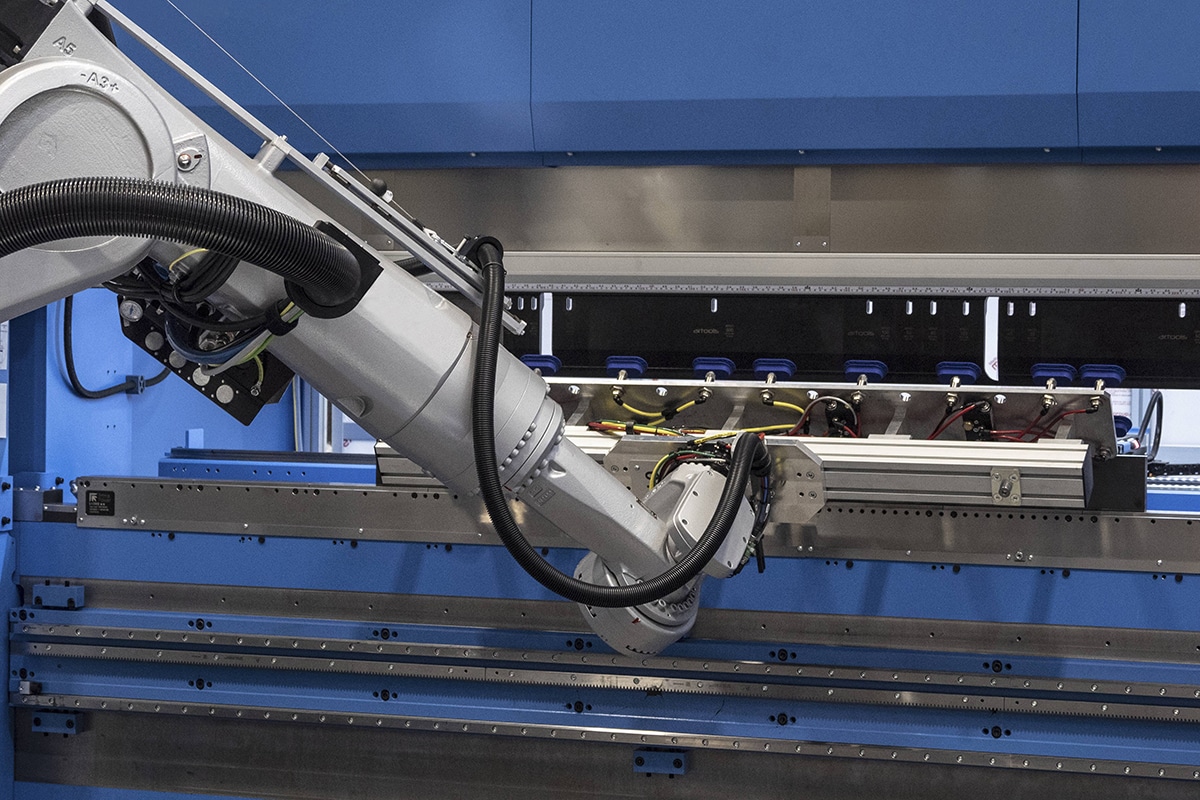

Difference between AMR and AGV

Omron also sees that development around mobile robots and AGVs is moving fast. Companies considering implementing this kind of help need to think about a few things carefully, though. Such as how the deployment of the tools fits within existing processes or even how to rethink processes. Gijs van Beek, field application engineer robotics: "For companies orienting themselves, it is good to know the differences between mobile robots (AMRs) and AGVs. An AMR can plan its own route or adjust it if an aisle is blocked. An AGV typically does not."

Consequences

So while vendors emphasize the benefits of automated material handling, they also emphasize the consequences of deployment for a company's internal organization. Krijger: "This applies especially to logistics. It regularly happens that companies do not know exactly where goods are and where they should go at what time. Storage capacity is available, but is not a core activity. Often a forklift driver is at the same time a kind of logistics planner, someone who knows where products are. Anyone who wants to take full advantage of automated material handling must have a clear picture of the physical handling within the company. The logistics flow is often not yet registered through a single system. However, this is necessary for such a solution. That is why we help the customer realize this."

'Start small'

Still, a total overview is not a requirement for starting with automated material handling, the vendors argue. "Start small, then it won't feel like a threat to employees," says Jaspers. "Let your people push all kinds of buttons first. You can always integrate the purchased equipment with other systems, such as an ERP package." Jaspers gives an example of a simple application of an AGV: "You can have an AGV put down a pallet without complicated links. Putting products or a pallet in a certain position based on an order number is more complex."

Peace in the workplace

Although the choice of automated material handling is often motivated by a lack of skilled personnel or competitive considerations, there are several other advantages. Krijger: "The use of these tools gives peace of mind on the shop floor. Efficiency also increases. A vehicle like an AGV does what it is told to do. Working near an AGV is predictable; you don't have to look around. In doing so, an AGV prevents damage and collisions." A client of KV Techniek was able to reduce the need for forklift drivers by deploying AGVs. Krijger: "This company opted for the nightly deployment of AGVs that put pallets away on the fifth floor. This saved two weekend shifts with two forklift drivers."

Especially starting

Right now, Jaspers and Krijger's main advice to companies in the metal and steel processing industry is to start above all else, on a small scale. Jaspers: "If you don't start, you might fall behind. You really won't be able to add the maximum value of automated internal transport to processes in the beginning. But you will gain experience and be ready for efficient deployment when needed."

Combining equipment

In the future, more possibilities for applications will arise, according to the suppliers. Such as allowing various types of internal transport to communicate seamlessly with each other and controlling them with one central tool. Krijger: "This is already possible for AGVs, robots and other systems from the same supplier. The central control of tools from various suppliers is still some time away." Jaspers sees this happening faster. "Communication between devices from various suppliers. That's what everyone dreams of. So that you can automatically deploy all kinds of systems between logistics and production."

Partnerships

Omron also sees many developments in this area. The company is betting heavily on partnerships. Van Beek: "So that we can deploy more types of vehicles within our platform." The supplier is also part of the VDA5050 working group. "Within that, we are developing a mixed fleet manager, which should make it easier to control vehicles from various suppliers with one system." The proprietary fleet manager also works with open industry interfaces. "That makes communication with systems such as MES, WMS and ERP easier."

Cost and payback period

That ideal world is still a bridge too far for many companies, but the threshold for investing in something like AGVs should no longer be. Jaspers: "The prices of our AGVs run from 35,000 to 60,000." Krijger: "The costs are manageable. An ordinary forklift quickly costs 50,000 euros, and so does a forklift driver. Suppose an AGV costs a ton, you have a payback period of one to two years. And that's at a time when labor is only getting more expensive."